This is why your Auto Insurance Rates went up in 2023

It seemed like the last thing we wanted to hear – your auto insurance rates went up this year! Whether you’re an Uber driver, own a business and use a personal vehicle as part of that venture, or just drive in general, no one enjoys having to shell out extra cash for their car’s insurance. But why are rates higher than they have been in the past? In this blog post, we’ll explore what caused auto insurance rates to spike in 2023 and how you can look into better coverage options. Keep reading if you want to understand what happened and find out what steps you should take now so that rate increases don’t surprise you again!

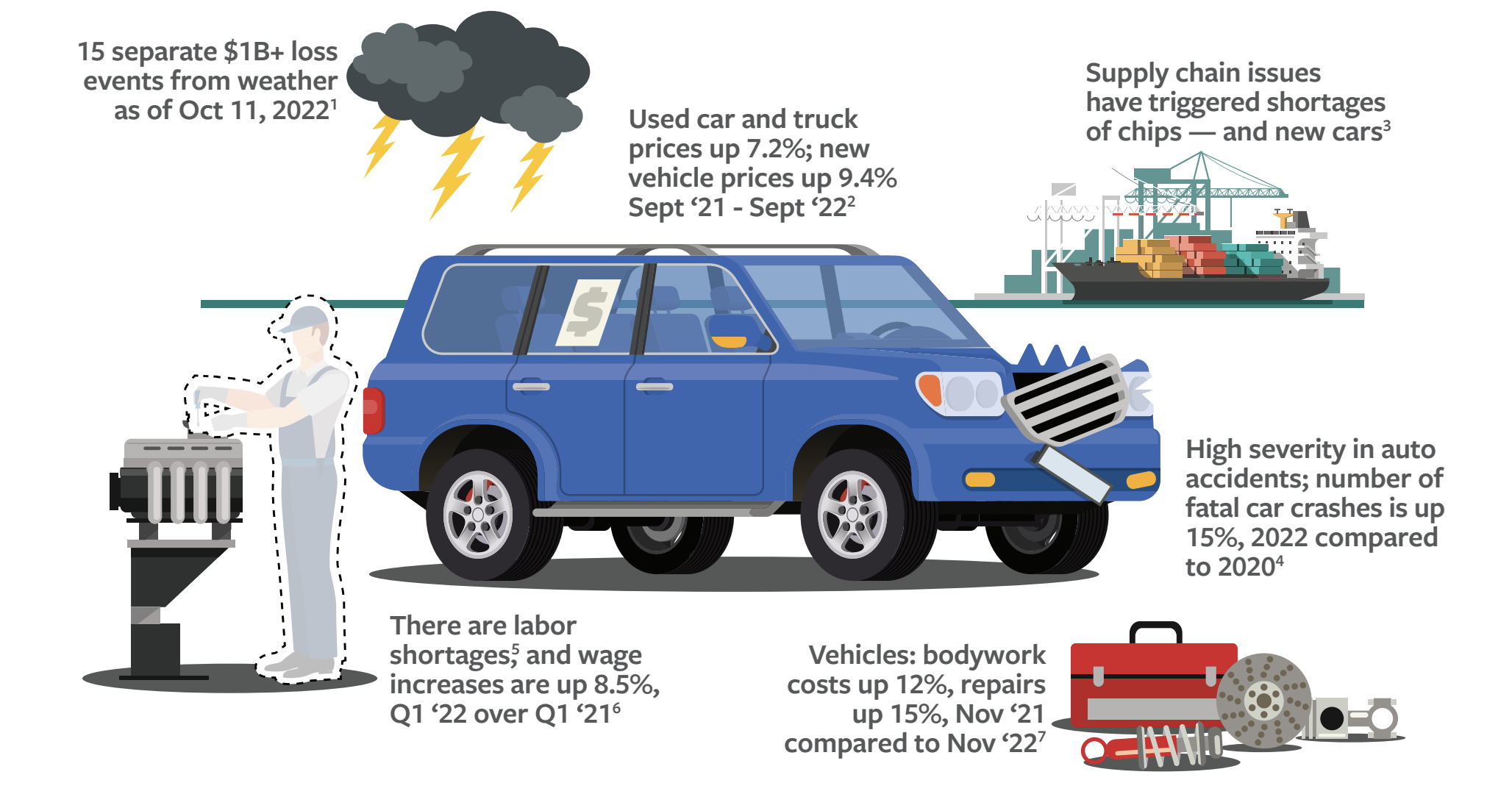

The many factors driving auto insurance rates in 2023

Inflationary pressures and shortages are contributing to the rising costs to repair and replace vehicles. Here are some of the factors that may affect premiums moving forward.

The many factors that are impacting risks and costs around the world, including:

– Impact of the pandemic

– Supply chain issues

– Increased demand and costs

– Extreme weather.

Source: www.travelers.com

Just remember: you probably have many benefits from the policies that you’ve already purchased, such as Longevity Credits & Decreasing Deductible credits, and you might lose them in case you switch carriers.

Some ways to save money…

a) BUNDLE UP! Bundle your policies and save up to 35% in premiums.

b) LOWER YOUR PREMIUMS by rising up your deductible.

c) SAVE THE MONTHLY INSTALLMENT FEE if you pay your premium in full.

d) REVIEW YOUR CURRENT POLICIES. Has anything changed since we last reviewed your coverage? Would you like to add new products, make changes or just save money? Contact us today so we can evaluate if you qualify for any new discounts.

Now that we’ve explored the various ways that auto insurance rates in 2023 can be impacted, from inflation to extreme weather, you should be better informed about your own policy. After all, it doesn’t help anyone to pay more than they have to for their coverage. Try bundling your policies with the same provider and paying your premiums in full to save time and money.

Ultimately for peace of mind having an experienced agent review your policy makes sense. Keep in mind here at Advantage America, our goal is to leave no stone unturned when it comes to helping customers get the right coverage that fits their needs at a price they can afford. So, don’t wait any longer—give us a call today, and let’s review your policies together.

Embrace the advantage

Be the first to receive exclusive news, tips, and discounts straight to your inbox. Don't worry, we don't spam.

Get Started Today!